All CVBC registrants in the Private Practice, Specialty Private Practice and Public Sector classes, including those with Provisional or Provisional Supervised registration, as of April 14, 2025.

The special fee must be paid in full on or before June 13, 2025.

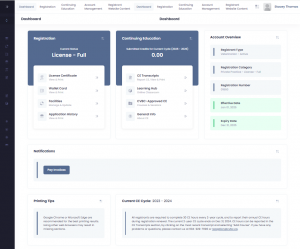

Every registrant who is subject to the special fee will receive an invoice by April 15, 2025 which will be available within their Online Registrant Account.

Log in to your registrant account by following this link or by using the Portal Login on the CVBC website. The invoice can be found on the main page of your online account, and is accessible by clicking on the “Pay Invoices” button under the heading “Notifications”.

Retired, Non-Practicing and Temporary registrants of the CVBC are not subject to the special fee. However, if they transfer into a class that is subject to the fee at any time during the assessment period (April 14, 2025 through April 13, 2026), they will be required to pay the special fee as part of their transfer process.

Anyone applying for registration in the Private Practice, Specialty Private Practice or Public Sector classes will be subject to the special fee upon registration.

Every registrant who is in one of the affected classes of registration as of April 14, 2025 must pay the special fee.

If a registrant applies to transfer to an inactive class or to resign their registration and their special fee is still outstanding, the CVBC will deduct the amount owing to the CVBC from any registration fee refund that would otherwise be issued to the transferring registrant.

No. The special fee is non-refundable.

No. The full amount of the special fee will be assessed during the entire assessment period, being April 14, 2025 to April 13, 2026, inclusive.

No. A registrant will pay the special fee only once.

A complete explanation is found here.

In summary, registrants have declined to raise fees since 2011. Inflation alone has increased the cost of goods and services by over 38% since 2011. The CVBC is legislated under the Veterinarians Act to regulate veterinarians and the delivery of veterinary medicine in the public interest. The duties that the CVBC is required by law to discharge are not discretionary; accordingly, the CVBC must have the financial resources to discharge its duties. Without the special fee, the CVBC would have faced a liquidity crisis by June 2025 and would have become insolvent soon thereafter.

Pursuant to s 28(1) of the Veterinarians Act, if the Minister of Agriculture and Food considers it to be in the public interest, the Minister may by order make a new bylaw. Pursuant to Ministerial Order No. M88, the Minister has ordered the special fee.

The consequences of a failure to pay the special fee are contemplated across sections 1.79 [Definitions], 1.83 [Failure to pay other fees, assessments, fines or costs by due date], and 2.27 [registration renewal] of the CVBC Bylaws.

Pursuant to section 1.83 of the Bylaws, the College’s Council has authority to direct payment of a late fee and/or the cancellation of the registrant’s registration. The College’s Council has directed that a late fee of $125, which is calculated on the basis of the 25% late fee rate contemplated in Schedule “C” of the Bylaws, be assessed the day following the payment deadline in the event that the special fee is not paid in full by the payment deadline. The late fee will be due 60 days from the assessment date of the late fee.

Pursuant to section 1.83(2) of the Bylaws, the Council is permitted to consider an application by a registrant for an extension of the payment deadline for the special fee on the basis of extenuating circumstances that prevent the registrant from paying the special fee by the payment deadline. More information and instruction on making an application are found here. Only complete applications in the prescribed form attaching all required supporting documentation will be considered by the Council. Please note that the Council does not have authority under any circumstance to waive the special fee.

Notwithstanding any of the above, failure to pay the special fee or the late fee by the end of the registration year will result in the special fee and/or the late fee, as the case may be, becoming an “outstanding fee, late fee, … special fee or assessment” as contemplated in section 2.27(1)(c) of the Bylaws. Pursuant to section 2.27(3), if the outstanding amount is not paid by the end of the registration year, then the registrar is required to cancel the registration of the registrant. For the avoidance of doubt, no authority lies with the registrar or with the Council to provide relief in respect of the effect of section 2.27(3) of the Bylaws.